Forex Brokers: Best Choices for Beginners and Experts

Forex Brokers: Best Choices for Beginners and Experts

Blog Article

Decoding the Globe of Forex Trading: Revealing the Value of Brokers in Making Certain and handling threats Success

In the complex world of forex trading, the duty of brokers stands as an essential component that usually stays shrouded in enigma to many aspiring investors. The significance of brokers exceeds mere transaction facilitation; it reaches the realm of threat administration and the general success of trading undertakings. By handing over brokers with the task of navigating the intricacies of the forex market, traders can potentially unlock a world of opportunities that could or else remain elusive. The complex dancing between brokers and investors reveals a symbiotic partnership that holds the key to unraveling the enigmas of profitable trading ventures.

The Role of Brokers in Forex Trading

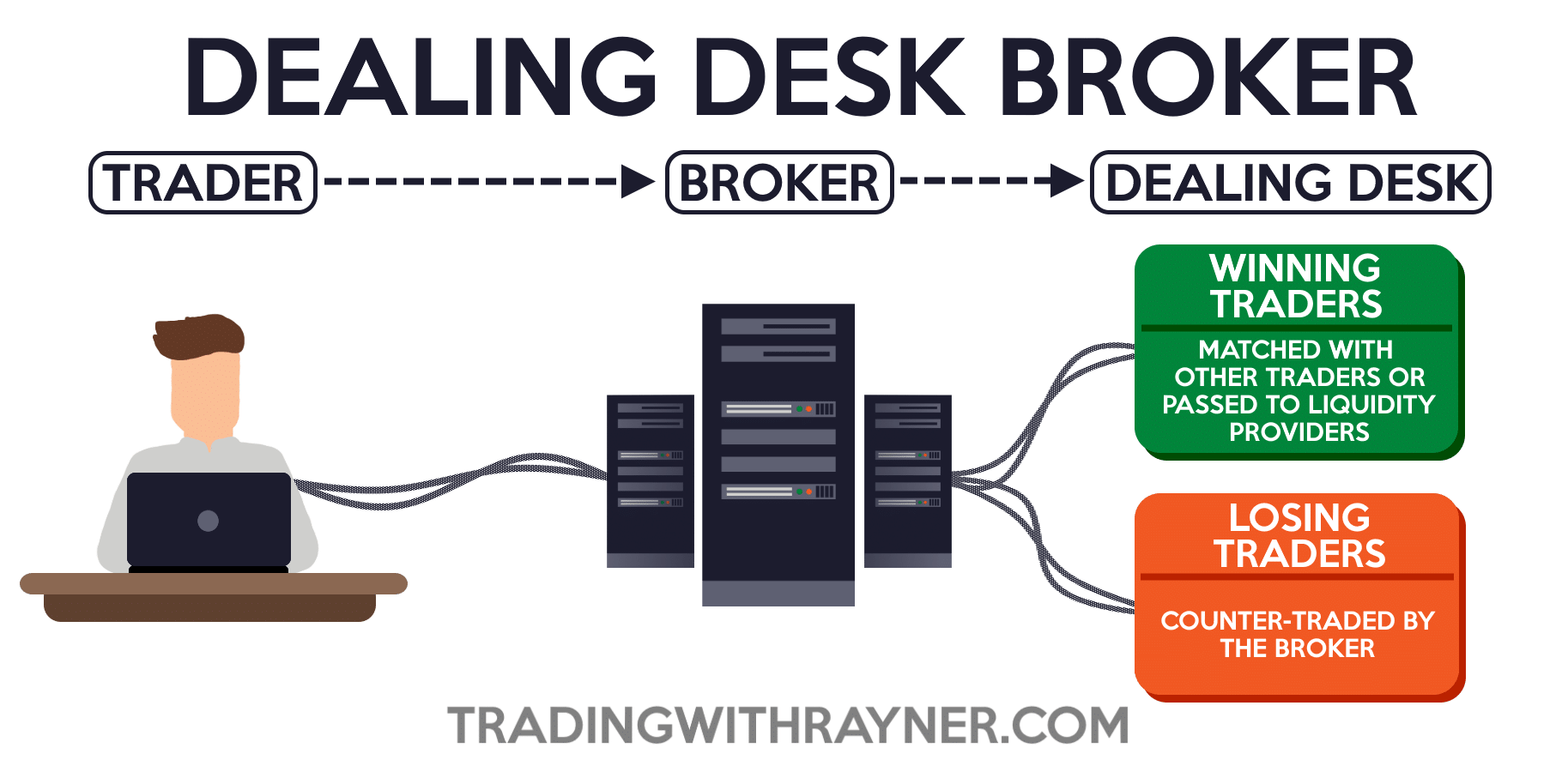

Brokers play a crucial duty in foreign exchange trading by offering essential solutions that aid traders handle threats successfully. One of the main features of brokers is to offer traders with accessibility to the market by promoting the execution of trades.

In addition, brokers provide instructional sources and market analysis to aid traders make notified decisions and establish efficient trading methods. In general, brokers are essential companions for traders looking to browse the forex market effectively and take care of dangers effectively.

Threat Management Strategies With Brokers

Provided the important duty brokers play in facilitating accessibility to the international exchange market and supplying threat monitoring devices, comprehending efficient approaches for managing threats with brokers is necessary for successful foreign exchange trading. One key technique is setting stop-loss orders, which enable investors to determine the optimum quantity they are eager to lose on a profession. This device assists limit potential losses and protects against adverse market movements. Another essential threat management strategy is diversification. By spreading financial investments throughout different money pairs and possession classes, traders can decrease their exposure to any kind of single market or tool. Furthermore, using utilize meticulously is essential for threat management. While take advantage of magnifies revenues, it additionally multiplies losses, so it is essential to use take advantage of carefully and have a clear understanding of its implications. Maintaining a trading journal to track efficiency, evaluate previous professions, and identify patterns can help investors refine their strategies and make even more educated choices, eventually boosting risk monitoring practices in forex trading.

Broker Selection for Trading Success

Selecting the right broker is extremely important for attaining success in foreign exchange trading, as it can considerably impact the general trading experience and outcomes. Functioning with a controlled broker offers a layer of security for traders, as it ensures that the broker operates within set requirements and standards, thus reducing the risk of fraudulence or malpractice.

Furthermore, traders need to assess the broker's trading platform and devices. An easy to use platform with advanced charting devices, quick trade execution, and a variety of order types can improve trading efficiency. Examining the broker's consumer assistance services is vital. Motivate and dependable consumer support can be important, particularly throughout unstable market conditions or technological issues.

Additionally, investors should assess the broker's charge structure, consisting of spreads, commissions, and any concealed fees, to understand the cost implications of trading with a certain broker - forex brokers. By very carefully reviewing these factors, investors can select a broker that aligns with their trading objectives and establishes the phase for trading success

Leveraging Broker Expertise for Profit

Exactly how can investors efficiently harness the expertise of their selected brokers to take full advantage of profitability in foreign exchange trading? Leveraging broker expertise commercial needs a calculated approach that includes understanding and using the services supplied by the broker to enhance trading results. One essential means to leverage broker expertise is by capitalizing on their study and analysis devices. Lots of brokers give access to market understandings, technical evaluation, and economic calendars, which can help investors make notified decisions. By staying educated about market patterns and events via the broker's sources, traders can identify successful possibilities and minimize dangers.

Establishing a good relationship with a broker can lead to personalized guidance, profession recommendations, and danger administration techniques tailored to individual trading styles and objectives. By communicating frequently with their brokers and looking for input on trading strategies, investors can tap into skilled understanding and boost their general performance in the foreign exchange market.

Broker Assistance in Market Analysis

Broker help in market evaluation extends beyond just technological analysis; it likewise includes essential evaluation, belief evaluation, and danger administration. By leveraging their expertise and access to a vast array of market information and study devices, brokers can aid traders browse the intricacies of the forex market and make well-informed decisions. Additionally, brokers can offer prompt updates on financial events, geopolitical growths, and various other factors that might affect currency costs, allowing investors to remain ahead of market fluctuations and change their trading settings accordingly. Eventually, by utilizing broker aid in market analysis, traders can boost their trading efficiency and increase their possibilities of success in the competitive foreign exchange market.

Verdict

In verdict, brokers play an essential role in foreign exchange trading by handling dangers, offering expertise, and assisting in market evaluation. Choosing the best broker is important for trading success and leveraging their knowledge can bring about earnings. forex brokers. By making use of danger administration strategies and functioning very closely with brokers, traders can browse the intricate globe of foreign exchange trading with confidence and increase their opportunities of success

Provided the vital role brokers play in helping with accessibility to the foreign exchange market and providing threat management devices, comprehending effective strategies for managing threats with brokers is vital for successful foreign exchange trading.Selecting the appropriate broker is critical for accomplishing success in foreign exchange trading, as it can substantially impact the total trading experience and results. Functioning with a controlled broker gives a layer of protection for traders, as it ensures that the broker operates within established requirements and standards, thus lowering the danger of fraudulence or malpractice.

Leveraging broker expertise for revenue requires a strategic strategy that includes understanding and making use of the services offered by the broker to enhance trading end results.To successfully exploit on broker proficiency for revenue in forex trading, traders can depend on broker aid in market analysis for More Help informed decision-making and threat mitigation approaches.

Report this page